By Katia S.

Why Are Your Insurance Policies More Expensive in 2023?

Ever catch yourself wondering why on earth your insurance costs are soaring to new heights? I feel you! It's like a never-ending cycle of expenses that are draining our bank accounts faster and faster. But fear not, my friend, because today we're going to dig deep and uncover the secrets behind these skyrocketing insurance costs. Get ready to unravel the mysteries, expose the culprits, and maybe even share a few eye-opening anecdotes along the way. So, grab a comfy seat, put on your detective hat, and let's demystify the perplexing world of rising insurance prices!

Understanding the 2023 Insurance Rate Hike

Ever catch yourself wondering why on earth your insurance costs are soaring to new heights? I feel you! It's like a never-ending cycle of expenses that are draining our bank accounts faster and faster. But fear not, my friend, because today we're going to dig deep and uncover the secrets behind these skyrocketing insurance costs. Get ready to unravel the mysteries, expose the culprits, and maybe even share a few eye-opening anecdotes along the way. So, grab a comfy seat, put on your detective hat, and let's demystify the perplexing world of rising insurance prices!

Economic Factors

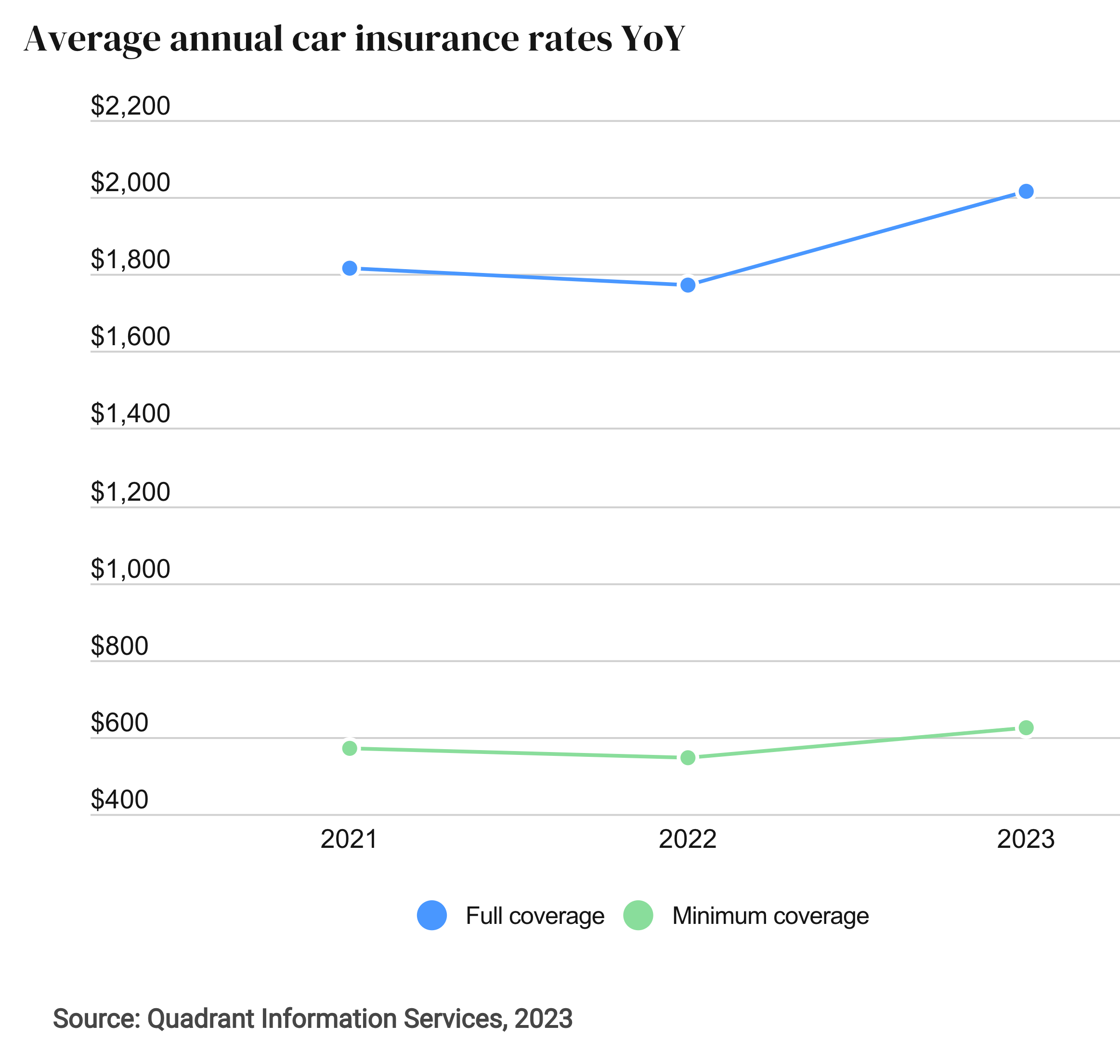

Oh, inflation, the notorious troublemaker wreaking havoc in the insurance industry! You know, it's like that mischievous cousin who always shows up uninvited and causes chaos at family gatherings. In this case, despite the average annual premium failing to keep up with inflation rates, we're in for a not-so-welcome surprise: auto insurance premiums have hiked up in 2022 and 2023. It's like adding insult to injury, right? But wait, there's more! Inflation has also brought along its sidekicks, like the unexpected decline in the prices of used cars. Sounds like a good thing, huh? Well, not so fast. This decline has triggered a domino effect, causing car repair costs to skyrocket by a whopping 37 percent from December 2020 until now. It's like a never-ending game of cat and mouse, where the costs keep chasing us while we desperately try to keep up.

This causes various factors related to auto accident expenses like hospital visits, claims checks associated with total loss situations and rental car costs, etc., all contribute to increasing car insurance rates despite hopes for full coverage car insurance not decreasing due partly because of stable vehicle price points.

Natural Disasters and Climate Change

The ever-growing frequency and severity of natural disasters, such as tornadoes, hurricanes, floods, earthquakes, and wildfires, that are caused by climate change, have had a major impact on car insurance rates. This means the cost of coverage in this sector has been pushed up significantly due to these risks associated with weather events.

Insurers need to be prepared for more difficulties posed by Mother Nature if they want to remain competitive within the industry. Adapting is necessary so premiums stay affordable despite increasing costs tied to providing adequate protection against any sort of disaster or hazard.

Repair Costs and Labor Shortages

Due to an increase in repair costs and labor shortages, insurance companies are raising premiums. This is because these elevated expenditures need to be taken into consideration when assessing risk. If the cost of repairs exceeds what a car's worth, then the insurer will pay out its book value instead. Less available technicians for necessary work drive up expenses even more. Insurers have no choice but to raise their rates as they factor this additional cost into account. Consequently, we see this rise in insurance across various companies and policies today.

Soaring Car Repair Expenses

When examining insurance rates, the rise in car repair costs must be taken into account. This is due to supply chain issues and labor shortages experienced by auto companies that have driven up prices substantially. Even though these expenses represent just one of several factors influencing premiums, their impact cannot be ignored as we move toward 2023. Companies will include such heightened repair costs when calculating what individuals pay for their policies. Thus, being mindful of this surge should prove beneficial if seeking out more affordable options for your vehicle's protection against unforeseen damages or losses.

Impact of Labor Shortages

The insurance industry will be impacted by more labor shortages in 2023 and car owners should understand how it affects their coverage. Insurers may experience longer wait times for repairs due to a lack of workers, driving up costs as well as raising car insurance rates when rental reimbursements are maxed out. Additional risks can occur if there is an overburdened workload with decreased productivity from staff turnover related to the shortage. Knowledge about this issue could help you make informed decisions regarding your relevant policies and rates next year.

State Regulations and Minimum-Coverage Laws

Insurance costs can vary greatly depending on the state. Regulations imposed by local authorities are put in place to limit rates that could be considered too high or discriminatory and these laws have an impact on the cost of insurance premiums for 2023. When it comes to car insurance, states establish their own minimum coverage requirements which affects how much you will end up paying in terms of your policy's rate. Different laws across various jurisdictions account for discrepancies between different areas when it comes to auto-insurance fees and charges.

Differing State Requirements

The variation in car insurance prices across states can be attributed to different minimum coverage standards. For instance, Michigan and New York's stringent regulations result in elevated premiums when compared with other areas. The impact that state requirements have on the disparity of auto insurance rates is significant and should not be underestimated when making a decision about your policy or searching for cost-effective deals local to you.

High-Premium States

Living in a high-premium state brings its own set of insurance challenges. This is due to factors such as more expensive vehicles, costly repairs, and an increase in weather-related claims linked to climate change all resulting in higher premiums than other areas. It's important for residents of these states to be knowledgeable about the extra coverage requirements which could affect their costs when obtaining insurance in 2023. Being aware now allows individuals to make better choices concerning what type and how much coverage will best suit them financially moving forward.

Summary

As you have now learned, there are numerous factors that can influence the cost of your insurance policy. That's why we strongly encourage everyone to stay informed and stay ahead of the game when it comes to making the best decisions for your coverage. Being knowledgeable about the options available to you will empower you to choose the policy that suits you best. So, stay up-to-date with the latest information and trends in the insurance world, because being informed is the key to making smart choices.

Get Coverage With A-MAX

No need to stress about finding the perfect policy to fit your needs. Our dedicated team is here to do all the heavy lifting for you. We'll search high and low, turning every stone, to find the best coverage that suits your unique requirements. You can trust us to have your back, rain or shine.

So, what are you waiting for? Don't keep those insurance questions and concerns to yourself. Give us a shout today at 800-921-AMAX or chat with an agent, and let us show you the A-MAX difference. We're eager to assist you and make your insurance journey a breeze. Contact us now and experience the joy of hassle-free coverage!

Let's Start Saving

Convenient Locations

and chat with a friendly agent!